CONVEYANCING – BUYING A PROPERTY IN SPAIN

If you are thinking about buying a property in Spain, this is the blog you should read.

BUYING A PROPERTY IN SPAIN

Reuters Solicitors provides full legal service in relation with property purchases based in Spain.

Our English speaking lawyers will be willing to assist you with the purchase of your property in Spain.

BUYING A PROPERTY IN SPAIN

Our conveyancing service includes the following:

1.- Deposit contract/purchase contract or “Arras”.

We recommend you to contact us before accepting the purchase offer and sign the deposit contract. We will explain you the process and we will solve your doubts and questions. We will also inform you the estimate cost of the process and all the expenses involved.

It is advisable that the solicitor checks the deposit contract (called “contrato de arras” in Spanish) before transferring the deposit as they can include “abusive clauses” that can be against your rights. Our solicitors will go through the arras contract and we will make sure that terms and conditions follow Spanish Law. Once the terms are agreed with the vendor´s solicitor, we will draft the purchase contract and we will sign it with peace in mind.

2.- NIE certificate.

NIE is a fiscal number for non-residents. It will be your Spanish tax identification number. The foreign identity number (NIE) is granted by the Ministry of the Interior

It is mandatory to obtain a NIE when purchasing a property, or any other transaction in Spain, such as: selling a property, starting a business, applying for a mortgage, opening a bank account, etc.

We will assist you in obtaining your NIE certificates by being present with you to make the application at the Police Office (our solicitor will accompany you) or our solicitor can do it on your behalf if you give us Power of Attorney which is more than recommended.

3.- Power of Attorney (POA)

Many clients are not able to be present on the day of the signing/completion day, so the best option is to grant us a Power of Attorney so that we can act on your behalf.

The POA can be done either in Spain or in your own country:

- If you do it in Spain: We will accompany you to the Notary´s office to signing it. A translator will be necessary so as to translate the document into your mother tongue.

- If you are in your country: We will mail you a draft POA which will follow Spanish Law so you can legalize it in your country by making an appointment at your local Notary Public. We will also mail you all relevant information and instructions for your knowledge.

Once the POA is signed by the local Notary, the POA document will need to be legalized with The Hague Apostille at the Foreign and Common Office (FCO) so that it can be used in Spain. Your local Notary Public will assist you with this matter.

4.- Land Registry Search

We will conduct a Land Registry check to ensure that the property matches the registry of the property. We will also make sure that all transactions showing on the title deeds are properly and accurately recorded at the Land Registry.

We will verify that the vendors are the legal owners of the property and if the property description on the Land Registry Report matches the current estate of the property.

The Land Registry certifies whether or not there are charges, mortgages, debts or embargos against the property.

5.- Spanish Bank account

We will open a Spanish bank account as part of our conveyancing package where you will make payments of bills, taxes by direct debit. The account will include internet banking in English and a debit card.

6.- Council Tax, utilities and fees

– IBI Tax (Council Tax): IBI is a local tax from the Council Tax which is paid annually. We will check that this tax is paid and that there are no outstanding debts before the signing. We will also inform the Town Hall of the new ownership once the completion is made and we will set up direct debits from your Spanish bank account so that you do not worry about paying the tax.

– Utilities (electricity, water, gas, etc): We will obtain up to date statement from the owners/sellers and we will check that all bills are paid before completion.

We will change all utilities contracts after completion so that there are on your name, and we will also order direct debits to your Spanish bank account so they get paid monthly.

It is important to say that debts can be registered against the property in Spain, so it is important that all debts are cleared prior completion at the Notary.

– Community fees: Most of the properties belong to a community which is maintained by all property owners (I.e.: garden, lifts, maintenance, swimming pool, etc).

We will check that community fees are up to date before completion and we will contact the community administrator/president of the community in order to change the ownership into your name once the purchase takes place. Of course, we will set up direct debits from your Spanish bank account so that the community fees are paid (monthly, every three months or annually).

7.- Energy Efficiency Certificate

The Energy Efficiency Certificate (EEC) is a certificate which shows how efficient the property is. Since 2013, it is mandatory that the property has a valid and updated EEC issued by a qualified professional with the legal registration at the Ministry of Industry. We will ensure that this document is in place as part of our legal service.

8.- Habitation Certificate (Licencia de 1ª Ocupación)

We will ensure that the Habilitation Certificate Document has been granted at the Town Hall and Authorities.

This certificate is required by utility companies require in order to set up new contracts after completion.

9.- Costs of buying a property in Spain

Before completion, we will inform you about the total cost of the process by sending you a Completion Statement which will detail all associated costs of the process.

The cost of the process will vary depending on the purchase price. Just as an example, we will say:

- Notary fees: €500 – €700

- Land Registry: €300 – €500

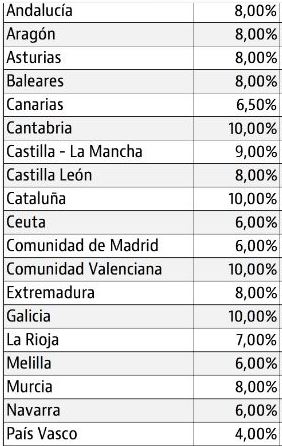

- Property Transfer Tax: It is called “Impuesto de Transmisiones Patrimoniales (ITP)”. This tax varies depending of the region of Spain where the property is located at:

This per cent is applicable to the purchase price.

If the seller is a non-resident, a sum equal to 3% of the purchase price is deducted and paid to the tax authorities. This is to ensure that the vendor does not leave Spain with unpaid taxes.

10.- Notary Signing

Once everything is prepared for the signing, we will make an appointment at the Notary. It is usually done at the Notary office closer to where the property is located and it takes 2 hours approximately to complete.

We will attend the notary, either with you or with the Power of Attorney.

11.- Title deeds

After the signing at the Notary, we will pay the Taxes (ITP) and the purchase deeds will be sent to the Land Registry for it legal inscription.

We will receive the formal title deeds from the Land Registry after 5 or 6 weeks after the signing.

12.- Spanish Mortgage

If you need to finance the purchase of your property, we will assist you with this matter.

13.- Will

We recommend to legalize a will once you buy a property in Spain. The Spanish Will will cover all your assets in Spain. It is written as per Spanish formalities, but follows European Inheritance Laws.

The Will will be drafted in two columns Spanish and English. The document will need to be signed in front of a Notary (either Spanish or English).

Once the document is legalized by the Notary, we will register it in the General Register in Madrid.

14.- Currency transfers

We provide our clients with the best exchange rates. This is why we word with Smart Currency Exchange and Magna Financial.

If you are thinking of buying a property in Spain do not hesitate to contact us.

We will provide you free consultation.

RELATED ARTICLES