MONEY CLAIMS IN SPAIN : MONITORIO PROCESS:

In this post we explain you either to how to claim a debt or credit in Spain or contesting to a claim against you.

Monitorio procedure in Spain is regulated in title III, chapter I, Articles 812 to 818 of the Civil Procedure Spanish Law (LEC).

This type of procedure was created in order to strengthen the protection of credits. It offers effective and quick protection to recover money debts and it is currently one of the most widely used civil procedures.

CARACTERISTICS OF THE RECOVERABLE DEBT

The debt must meet the following criterias:

- it must be in monetary form

- it must be a precise amount

- it must be a liquid asset

- the deadline for payment must have expired

- it must be recoverable in any proportion

Until May 2010, creditors could only claim through this Monitorio procedure debts up to € 30,050.00. Since May 2010, the limit raised up to € 250,000.00.

But the key of this process is that with the application, it should be provided enough evidences and documentation in order to proof that there is a debt.

ADVANTAGES

The Monitorio process has quite a lot advantages:

- Quick system

- No limit to value of claim

- Low costs

- Easy of enforcement

WHAT DOCUMENTATION IS REQUIRED?

As previously mentioned,it is necessary to provide enough evidences and documentation in order to proof that there is a money debt.

For that reason:

- We need to prove the relation between parties with documentation (i.e.: contract)

- We need to prove the amount of debt with documentation such us invoices, certifications, bills, confirmations orders, etc.

- It would be good to prove the origin of the debt and the reasons for the claim submitted.

- It is important that these documents are somehow signed by the debtor and not unilaterally produced by the creditor.

- If a Burofax has been submitted prior Monitorio´s claim, it is convenient to submit it with the claim.

WHERE CAN I SUBMIT THE CLAIM?

The Civil Procedure Spanish Law (LEC) says that the claim can be submitted at the Court where is the:

- Residence of the debtor

- Place of business of the debtor

- If the domicile or residence is not known, it can be used the address where the initial payment should be done.

- In the case of a claim of expenses of community owners, the claim can be presented where the property is located.

HOW THE PROCESS STARTS?

Although it is not mandatory, we recommend you totry to solve the conflict by sending a formal requirement which is known as Burofax. A Burofax is a legal letter where you inform about the debt, the obligation of the debtor to pay it, and giving the debtor a deadline to pay.

The Burofax has to be submitted at the Spanish post and it certifies not only the dispatch, but also the content. Moreover, the Burofax is also a legal proof at Court. It is the best way to prove that you try to solve the dispute out of Court and prove your good will.

Once the debtor has not voluntary paid after the deadline, creditor can start Monitorio Procedure at Court:

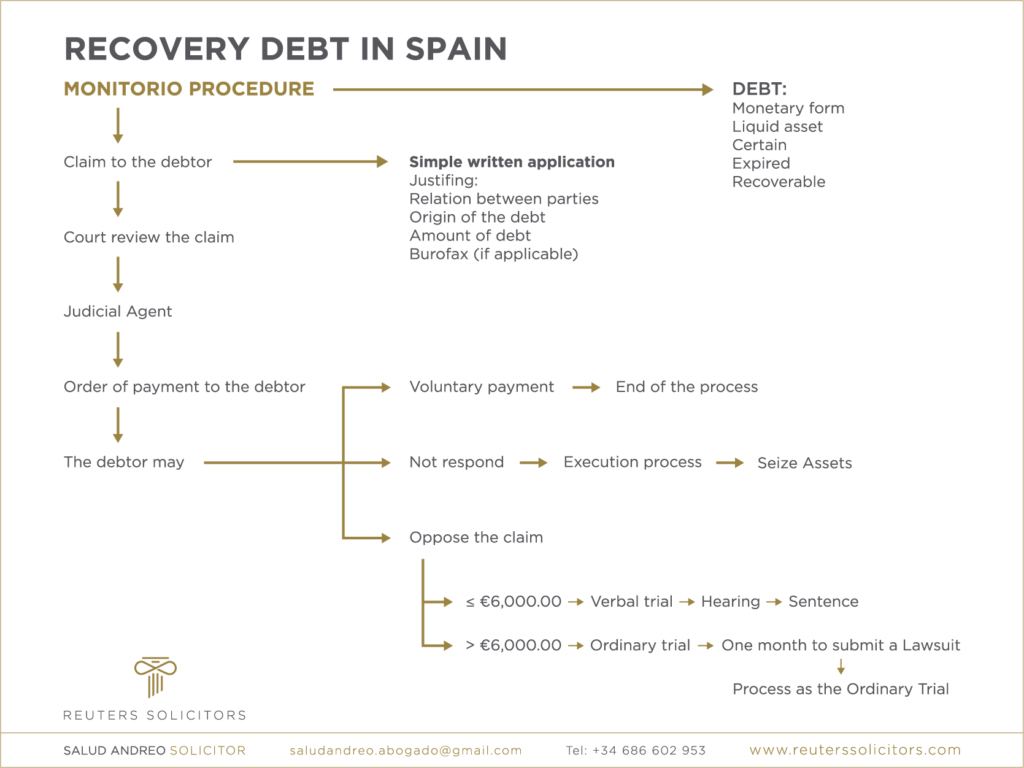

MONITORIO PROCEDURE

As we have mentioned before, the law provides that the payment shall be due and creditor must have the appropriate evidence of it. These requirements are essential in order to initiate the Monitorio procedure. Creditor must file a written plea before the corresponding trial court submitting all evidences at that time (documentation previously mentioned).

The Judicial Agent of the Court will review the claim and the filed documentation and, if appropriate, the court will send an order for payment to the debtor.

Once the order of payment is served, the following scenarios are possible:

1. The defendant voluntary pays.

Debtor has 20 days’ deadline to satisfy the due amount upon receiving the order of the Court. The Judicial Agent of the Court will confirm the payment and will be added to the judicial record. Failure of payment is the end of the procedure. The court will order then the closing of the file.

2. The defendant contests the claim.

If debtor objects to pay within 20 days, the Court will end the Monitorio procedure. The defendant must reply in writing outlining why they oppose the claim and providing relevant documentary evidence. The defendant can dispute all or part of the claim.

In this circumstance, the creditor could file another similar lawsuit within the ordinary procedure before the same Court. There are two different scenarios:

Verbal Trial:

For disputes up to the value of € 6,000.00.

The Judge will arrange a Hearing where parts will dispute the debt.

After the Hearing, the Judge will give his judgement.

Ordinary Trial:

If the amount exceeds € 6,000.00.

The debtor will have 1 month to submit a Lawsuit (“demanda de juicio ordinario”).

The process will follow as the Ordinary Trial.

3. The defendant does not respond.

If the defendant does not reply the claim, the claim will be accepted and will pass to the Execution process.

HOW IS THE EXECUTION PROCESS?

The judgment closing the file at Monitorio process is automatically enforceable. This judgment is equivalent to one of the aforementioned titles that are directly enforceable as per Article 517 Civil Procedure Spanish Law (LEC).

Once the order is issued, the amount will accrue interest as per Article 576 LEC, which consist on the legal interest of the money increased in two points, the agreed interest payment or special provision of the law.

The debtor´s assets can be seized in order to pay the debt. A separate enforcement body is not required.

All these circumstances make Monitorio proceeding very popular, because the creditor can receive a writ of enforcement pretty fast, although it will depend on the load of work of the specific Court where the case is studied.

Related articles:

REUTERS SOLICITORS can help you with Monitorio procedure.

If you need advice in relation to either claiming money in Spain or contesting to a claim against you, do not hesitate to contact us for more information.

Hi,

I am a Exchange Student Who did my Internship in Spain. I had veen staying in a house for 5 months For which I gave deposit of 300 Euros and when I return the house my landlord was reckless and she made me wait for amonth and gave 200 euros Holding 100 euros for herself. When I ask her for rest she said me to wait for 15 more days and after that She dint Respond me and even Blocked me.~

I have the contracts and Back Transaction details

Chat history and Conversations

Details About her

I wanted to ask is there Something I can Do. Please contact me through Email If possible.

Dear Sir,

Thank you for contacting Reuters Solicitors. It will be a pleasure to assist you with this matter.

We will send you a private email with relevant information about the process. Please check your emails (and spam box).

Regards

I am also a foreign student whom signed a contract, which specified a deposit of 650 euros, which I wired to his account. I have all of my bank records for every month. I am sure he would have never renewed my contract for another year had I not been up to date. I lived there for 2 years. I always paid, and made extra sure the apartment was spotless as I

paid a maid to clean it. There was no damage done as I took good care of the apartment, andI never complained about the terrible water pressure. All of this for him to try to take advantage of me, as he does to other young students. I truly hope you can help me as it has been since May 31 since I moved. Before I moved I sent an email requesting a walk thru and return of my deposit yo the realtor. The response indicated that all was well and that he had 30 days. Even the realtor is wondering why he hasn’t returned it. He’s claiming he needs to review his accounts but I sent him all bank wire receipts showing that I paid in full for every month during the past 2 years and still he has not returned my deposit. Can you PLEASE help me. I am a foreign student studying in Madrid for 3rd year and this would help my expenses. Also, I want him to know it’s not okay to take advantage of people.

Dear Mercedes,

Thank you for contacting Reuters Solicitors. It will be a pleasure to assist you with this matter.

We will send you a private email with relevant information about the process. Please check your emails (and spam box).

Regards

Dear Andreo Salud,

I read about the exchange student who only received 200 out of the 300 euros deposit.

Hence, if you can help him, perhaps you can advise me.

My landlord, who I’ve never met, as we have always communicated via the estate agent, still owes me 285 euros. Most of our deposit has been returned after waiting 3 months, but the landlord or agent decided to hold back 285 euros for 9 days rent, which had already been paid. The estate agent agreed with me verbally, but since I received most of my deposit, has not replied to any of my correspondence since. I have the contract and all other correspondence. What would you advise.

Kind Regards

M

Dear Michal,

Thank you for contacting Reuters Solicitors. It will be a pleasure to assist you with this matter.

We will send you a private email with relevant information about the process. Please check your emails (and spam box).

Regards

Since almost 2 months my we didnt get the deposit back and the agency doesn’t reply anymore after promising multiple times they would transfer the deposit of 850€. What can we do?

Dear Jessica,

Thank you for contacting Reuters Solicitors. It will be a pleasure to assist you with this matter.

We will send you a private email with relevant information about the process. Please check your emails (and spam box).

Regards

Like many others, I never received my deposit back. I never received a response when I inquired. I always paid my rent and have proof. I left the flat cleaner than when I moved in. I feel taken advantage of and hope you are able to assist me in getting my entire deposit of 750. It has been 4 months.

Dear Marie

Thank you for contacting Reuters Solicitors. It will be a pleasure to assist you with this matter.

We will send you a private email with relevant information about the process. Please check your emails (and spam box).

Regards

Hi guys, thanks for the site, it has great information, so big thumbs up for that.

I’m living in Barcelona and recently vacated an apartment after 2 years (of a 3 year contract).

I had paid a deposit of 2,400€ but the landlord deducted the outstanding bills (which was fine), but also an extra 200€ for «Covid cleaning» – I challenged them on this, as I had the apartment cleaned before I left, leaving it the same state as when I entered, I took photos to have.

They replied that the cleaning costs were for the sofa, cooker, etc but didn’t give a evidence (receipt), etc and refused to give the money back.

I know it’s ‘only’ 200€, but it’s very annoying – the apartment was totally clean, just normal ‘wear’, but no damages at all.

Is there anything I can do, or do I just have to swallow this and move on?

Thanks for any advice.

Dear Dave,

Thank you for contacting Reuters Solicitors. It will be a pleasure to assist you with this matter.

We will send you a private email with relevant information about the process. Please check your emails (and spam box).

Regards

Dear Sir/Madam,

I have deposited 1800 Euro and when we did contract sign-off leaving the house, did painted and cleaned with professionals on my own cost which cost me 600 Euro + 200 Euro. Owner mentioned, he deposited with government and need to claim which takes 3 weeks and also mentioned later that he will deduct for small repairs and so which is fine. It’s been a more than 4 weeks and still Owner didn’t return the deposit.

Not sure how to proceed legally ?

Thank you for your assistance,

Dear Sree,

Thank you for contacting Reuters Solicitors. It will be a pleasure to assist you with this matter.

We will send you a private email with relevant information about the process. Please check your emails (and spam box).

Regards

Hello, thank you for the article. It is very informative.

I am currently in a very concerning situation where I am owed 2550 euros back as my deposit. It has been close to 2 months and the landlord is not responding to me. This has been incredible infuriating and absolutely need this deposit back. It is completely unjust of this person. May you please contact me, letting me know the procedure and costs to have help in getting this deposit back? Thank you.

Dear Andrew,

Thank you for contacting Reuters Solicitors. It will be a pleasure to assist you with this matter.

We will send you a private email with relevant information about the process. Please check your emails (and spam box).

Regards

Hi

I have a similar problem above and the amount is around 600 euro+.

I have not received the deposit for our flat from my flatmate after 3 months and she is not answering my call or text. The housing agency said they could not help this issue even my name was on the contract. Wonder what can I do to claim my money back. Thanks for any advice.

Dear Jing Wen,

Thank you for contacting Reuters Solicitors. It will be a pleasure to assist you with this matter.

We will send you a private email with relevant information about the process. Please check your emails (and spam box).

Regards

Hi,

I saw your website online and wanted to see if I could get some advice how to pursue my situation.

I moved out of my apartment in Barcelona mid of March 2022, and still have not received my deposit back which should be around 500 euros.

The agency is not helping either and only said they will „remind him“. We had contact a month ago where he apparently showed me a photo where he sent me some money back (also a total wrong and too little amount) but this never reached my account.

He then also said he deducted the money since I didn’t pay the last months rent and actually said longer than I said. This was both wrong and I have proof I paid all money owed and moved out the day. He was even there and we both signed the contact.

I am now wondering what can I do to claim my money back. Thanks for any advice, I really appreciate it.

Kind regards,

Kira Gruber

Dear Kira,

Thank you for contacting Reuters Solicitors. It will be a pleasure to assist you with this matter.

We have just sent you a private email with relevant information about the process. Please check your emails (and spam box).

Regards

Hello. I lived in Barcelona and had my name on the electricity bill (Endesa). When I moved out the landlord was supposed to change the name but did not do it. Over 1 year after I moved i received emails and phone calls regarding 14 unpaid bills. There is records that i moved from this apartment. Now i have daily calls and emails from debt collectors saying they will bring this to court if I don’t pay. What can I do?

Hello,

I rented an apartment in with a contract from September 1 until June 30 of 2023,.However, due to a fire in the adjacent apartment one month and a half before the end of my contract, I left at the end of May instead (one month short of the contracted period). In addition, the propietario/agent entered my apartment without notice and/or permission while I stayed at a nearby hotel due to the fire residues (smell, particulate matter, etc.).

The propietario decided to keep my 500 euro deposit, claiming that I ended the contract a month sooner than stipulated.

Is there anything I can do to recover my deposit of 500 euros? How do I proceed from here? Where do I file my demand or complaint?

Dear Gettis,

Thank you for contacting Reuters Solicitors. It will be a pleasure to assist you with this matter.

We will send you a private email with relevant information about the process. Please check your emails (and spam box).

Regards

Hello please how do I contact you ?

Thanks

Dear Sir,

Please email us at: hello@reuterssolicitors.com

Looking forward to hearing from you.

Regards